This article offers an extensive examination of FintechZoom GME Stock Prediction, covering GameStop’s (GME) market performance, its relationship to FintechZoom in financial prediction, and forecast of GME’s stock trajectory. We will explore GameStop’s history, recent market trends and assess accuracy of FintechZoom predictive models; compare them with other prominent models as well as expert opinions and risks; discuss risks to investors – together let us guide us as we navigate the complexities surrounding GME stock predictions while offering valuable insights both short- and long-term investors alike! Join us as we navigate GME predictions into providing actionable insights that benefit short and long term investors alike!

GME Stock and Its Market Performance.

GameStop Corporation, one of the leading video games, consumer electronics and gaming merchandise stores since 1984, has an extensive history dating from its inception. Since the time, it has evolved into an important gaming hub, offering gamers a variety of goods and services. However its market capitalization (GME) has seen significant fluctuations recently as a result of various market developments.

Key Events Contributing to its Market Prominence

The market’s prominence grew for GameStop in at the beginning of 2021 because of a record short squeeze that was initiated by retail investors from Reddit community WallStreetBets that resulted in an enormous increase in GME stock prices, attracting international media attention, and further highlighting the power of retail investors. This was a turning of its past that triggered increased scrutiny from both regulators and investors.

What is FintechZoom?

FintechZoom is an innovative platform specializing in financial technology news and analysis. Offering in-depth analyses on different financial markets using advanced algorithms to predict stock performance, FintechZoom boasts user-friendly interface and comprehensive coverage, making it a valuable resource for investors and financial professionals.

Definition and Role in the Financial Technology Sector

FintechZoom stands out in the financial technology (fintech) sector by providing real-time financial data, market trends and predictive analytics in real time. This service plays an essential role in aiding investors make informed decisions with reliable stock market predictions from FintechZoom’s reliable stock market predictions. Furthermore, their innovative approach combines technology and finance for enhanced investment strategies and actionable insights.

How FintechZoom Influences Stock Market Predictions

FintechZoom Impacts Stock Market Predictions FintechZoom influences stock market predictions through sophisticated algorithms and analytical tools that accurately forecast stock performance. Retail and institutional investors value these insights highly as it provides both data-driven analysis as well as expert opinions. Furthermore, FintechZoom can play a pivotal role in shaping market expectations as well as informing investment decisions.

FintechZoom’s Methodology

FintechZoom Employs Analytical Tools and Techniques

To provide accurate stock predictions, FintechZoom utilizes various analytical tools, including machine learning algorithms, historical data analysis and real-time market monitoring. These tools are specifically designed to quickly process vast amounts of information quickly while providing up-to-date and relevant insights quickly and efficiently. Their approach prioritizes precision over adaptability in order to remain relevant in an ever-evolving market environment.

Accuracy and Reliability of FintechZoom’s Predictions

FintechZoom Predictions’ Accuracy and Reliability FintechZoom’s predictions are known for being accurate and reliable, often surpassing traditional financial forecasting methods. Their predictions are supported by extensive data analysis and rigorous testing that instils high confidence levels among its users. Previous performance reviews as well as user feedback consistently highlight FintechZoom as an indispensable financial market predictive tool.

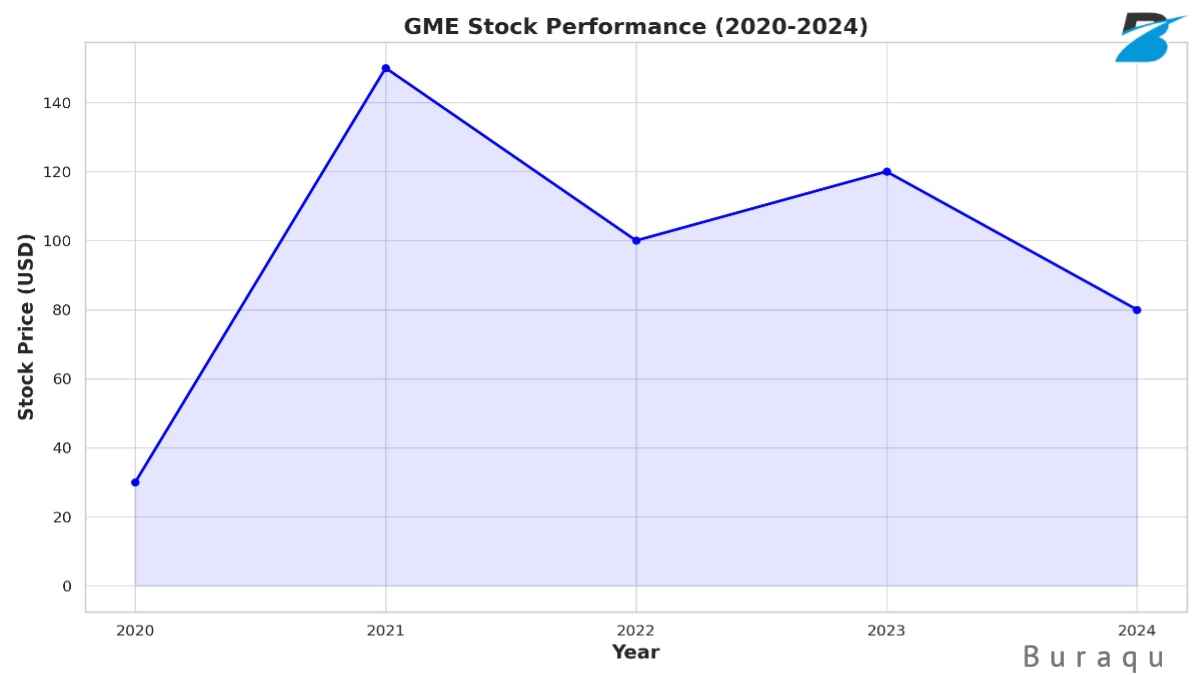

Historical Performance of GME Stock

GME Stock Timeline

Since GME’s humble beginnings to its remarkable growth and volatility during 2021, its history is marked by numerous major milestones. Each phase in this timeline provides valuable insight into market behavior – such as periods of growth, decline, or extreme fluctuations – which helps establish how its current market position came to be. By understanding GME’s Stock Timeline it becomes easy to gain perspective into all of the factors responsible for creating it.

GME Stock History

Major milestones include its initial public offering (IPO), various acquisitions and the defining events of the 2021 short squeeze that have contributed to shaping its present market position. Each event provides a window into market dynamics and investor behavior.

Key Events and Their Effect on Stock Performance

Events such as leadership changes, strategic shifts and market disruptions have had an enormously negative effect on GME’s stock performance, increasing its volatility and increasing risk. Understanding their significance helps investors better understand its risk factors and potential movements for the stock. Gaining historical context provides essential guidance in anticipating how similar events may influence it in the future.

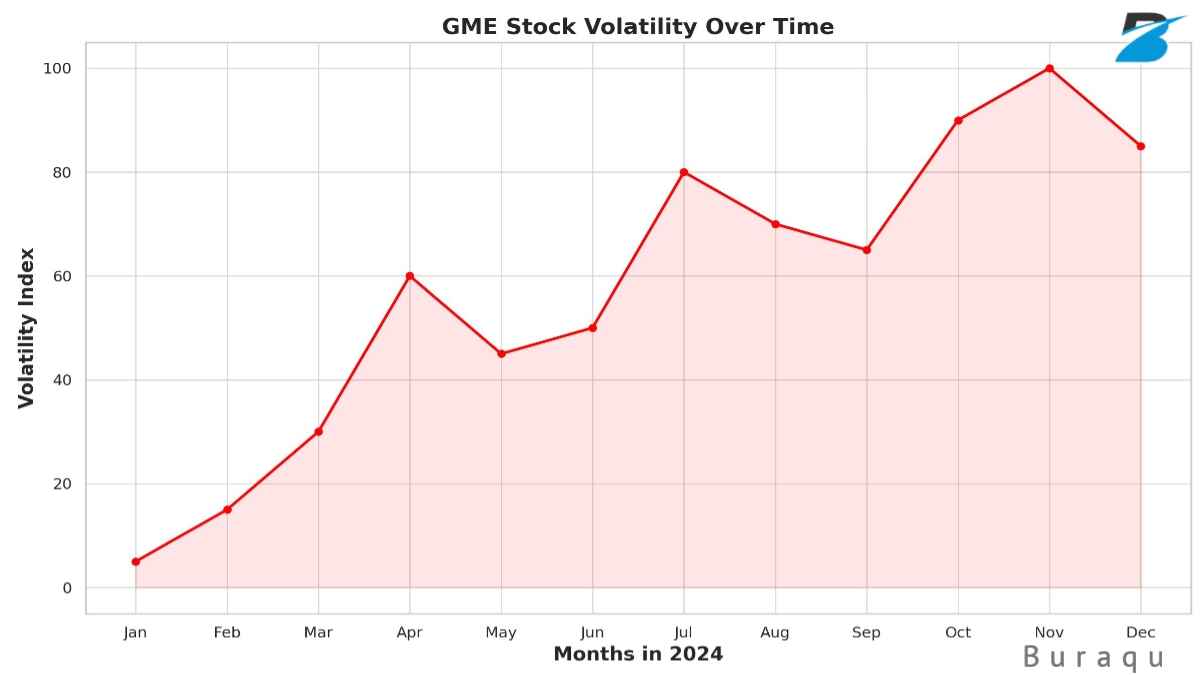

Market Volatility and Trends

GME Stock Volatility mes GME’s stock has shown high volatility, marked by rapid price swings. To gain insight into its market and manage risks effectively, investors need to understand this volatility. Volatility analysis involves looking at trading volumes, price changes and external influences that influence sudden shifts to obtain an accurate view of GME stock’s behavior under various market conditions.

Long-Term and Short-term Trends

While short-term trends reveal GME’s responsiveness to market events, long-term trends offer investors a comprehensive overview of its overall growth and sustainability. Comparing both timeframes can help investors create strategies that combine immediate opportunities with long-term goals; finding patterns in both timeframes may lead to more informed investment decisions.

Market Trend analysis currently being performed is as follows:

GME Stock Performance in 2024

Recent data highlights GME’s varied performance metrics in 2024. Comparing them to previous years allows investors to recognize patterns and predict future movements, such as quarterly reports, market reactions and competitive positioning analyses – offering them a comprehensive view of both GME’s current status and its expected trajectory.

Recent Performance Metrics

Key performance indicators for GME include stock price changes, trading volumes and market capitalization – three metrics which serve to demonstrate its current market stance. Analyzing these measures gives insights into operational efficiency, investor trust and positioning of the company – thus regular monitoring is important for tracking GME’s ongoing performance.

Comparison with Previous Years

By comparing GME’s performance across years, its current state can be better understood, providing context and providing insight into growth patterns and potential future trajectories. Doing this also reveals any cyclical trends or impacts from strategic decisions or market reactions to external forces and assists with setting realistic expectations of its future performance based on historical data.

Market Sentiment Analysis

Investor Sentiment and Its Influence on GME Stock

Investor sentiment plays a vital role in stock performance, with both positive and negative sentiment driving significant price swings. Sentiment analysis involves monitoring social media, news articles, and market reports to gauge public opinion and assess investor attitudes; understanding these sentiments helps predict market reactions and inform investment strategies.

Analysis of Social Media and News Coverage

Platforms such as Reddit and Twitter, along with news outlets, play an instrumental role in GME market sentiment. As such, understanding investor behavior becomes essential in monitoring these sources – monitoring social media trends or news coverage may prompt rapid price changes that reflect collective investor actions or shifts in market sentiment.

Also Red: Discover Fintechzoom GM Stock Trends: Key Strategies & Predictions

FintechZoom GME Stock Prediction

- Prediction Models

FintechZoom utilizes sophisticated prediction models incorporating both quantitative and qualitative data sources in order to accurately forecast GME’s stock performance. These models are built to adapt quickly to changing market conditions, providing real-time updates and predictions as needed. Integrating multiple sources further strengthens accuracy and reliability in these predictions.

- Description of the Models Used by FintechZoom for Prediction

FintechZoom utilizes predictive models including statistical analysis, machine learning techniques and real-time market data in its predictions. Combining historical and real-time inputs allows dynamic adjustments and refined forecasts. FintechZoom continuously updates their predictive models to include market trends and insights.

- Key Factors that Contribute to FintechZoom Prediction Models

Key factors affecting these prediction models at FintechZoom include market trends, economic indicators and company-specific news – these elements are weighted and evaluated to assess their effect on stock performance and can help facilitate understanding their interplay, which in turn assists with understanding predictions more clearly as well as their potential accuracy.

Read Also: PlugboxLinux Tech: The Best Ultimate Guide to PlugboxLinux 100%

Short and Long Term Predictions Available Here

FintechZoom Offers Accurate Prediction for the Next Quarter

FintechZoom’s short-term prediction offers investors insight into price movements based on recent market trends and investor sentiment analysis. Analyzing current data trends, the platform provides an accurate three month prediction to assist them in making informed investment decisions with short-term investments based on expected price ranges, potential drivers, and risk factors.

Long-Term Outlook for the Next Year

GME’s long-term outlook takes into account broader economic conditions, company performance and market dynamics to predict its future performance. FintechZoom’s annual forecast includes projected stock prices, anticipated trends and key events which may impact GME stock. This outlook helps investors plan for the long term by balancing potential returns with associated risks.

Factors Affecting FintechZoom GME Stock Predictions

- Internal Factors

GameStop’s key internal factors, including financial health, management decisions and strategic changes that influence stock predictions are examined via financial statements, corporate announcements and strategic initiatives. Such analysis provides insight into operational efficiency as well as future growth potential of GameStop.

- Company Financial Health

Analysis of Financial Health at GME Examining GME’s financial statements, revenue streams and profitability provides insight into its financial stability. Key indicators include earnings reports, cash flow statements and balance sheets; strong financial positions boost investor trust while contributing positively to stock performance while weaknesses pose considerable risks.

- Leadership Decisions and Changes

Corporate decisions have an enormous effect on investor trust and stock performance. Major decisions like changes to management, strategic pivots, or major initiatives are closely monitored by investors; good decisions may drive growth while poor decisions could cause it to diminish further, thus decreasing stock value and market confidence.

- External Factors

External factors, including market trends, economic health indicators and consumer behavior can have a direct effect on GME’s stock performance. Such macroeconomic indicators as GDP growth, inflation rates and consumer spending all influence GME stock performance in some way; understanding these external influences helps investors predict market movements more accurately while adapting strategies accordingly.

- Changes in Regulation and Their Potential Impact

Regulation can have profound ramifications on GME’s market operations and stock price. Any shift in regulations could alter market dynamics, impact company operations or alter investor behavior; keeping abreast of potential regulatory shifts is therefore key for accurately assessing risks and opportunities in the stock market.

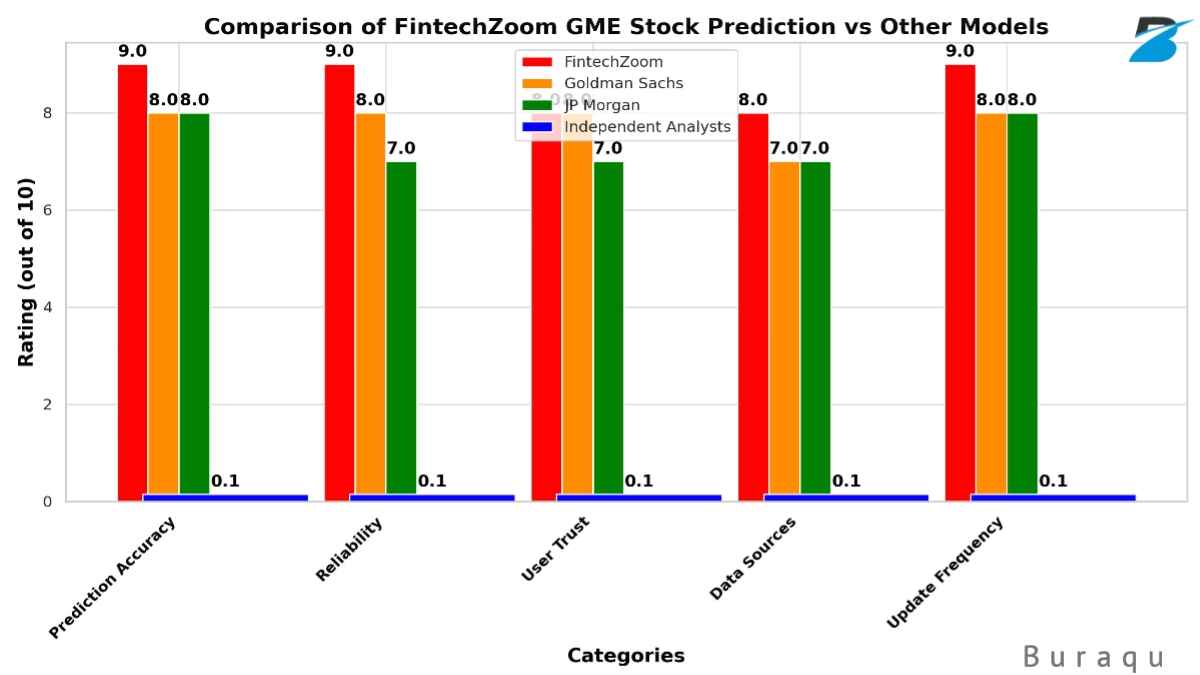

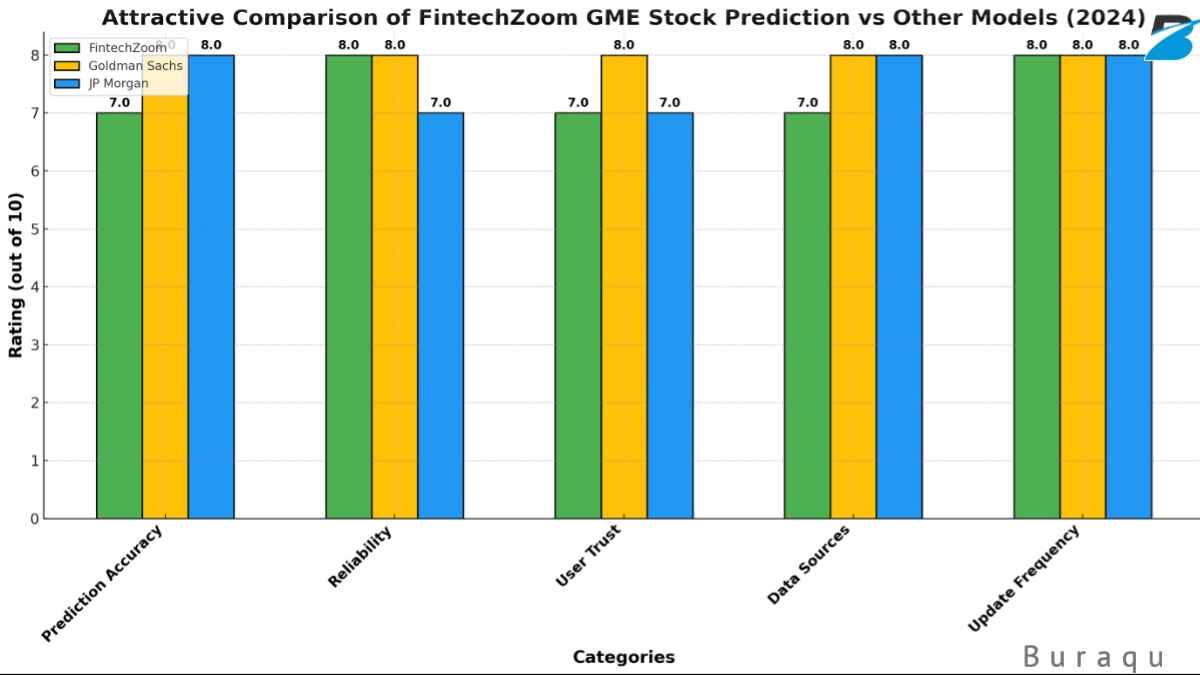

Comparative Study between Other Prediction Models

- Review of Competing Prediction Models

Many other prediction models from financial institutions and independent analysts offer alternative forecasts of GME’s future performance, using different methodologies and data sources for their forecasts. Comparing these models helps investors evaluate each approach individually to assess its strengths and weaknesses.

- Brief on Other Prominent Prediction Models

Highlighting prominent financial institutions allows investors to compare the accuracy and reliability of different prediction models. Prominent models from institutions like Goldman Sachs, JP Morgan, and independent analysts provide useful insights into market trends and stock predictions – understanding these models helps investors diversify their sources of information.

- Comparing These Models With FintechZoom Predictions

Analyzing these models helps evaluate FintechZoom’s standing and effectiveness as an investment prediction service. Analyzing each model’s methodologies, data sources, and prediction outcomes provides a full picture of its reliability; ultimately helping investors make informed investment decisions based on multiple predictive insights.

Accuracy and Reliability Are of High Importance

Historical Accuracy of FintechZoom Vs. Other Models

Deliberately reviewing past performance of FintechZoom’s predictions against other models helps establish its credibility. Historical accuracy reviews compare predicted outcomes with actual market performance over specific time frames. This examination highlights FintechZoom’s predictive strengths while simultaneously pinpointing areas for improvement.

Feedback from Users and Experts

Reviews and opinions provided by both users and experts provide insight into the practical reliability of FintechZoom forecasts. User accounts offer firsthand accounts of platform effectiveness while professional opinions provide professional assessments; both perspectives provide essential knowledge regarding FintechZoom’s influence over investment decisions.

Expert Opinions and Market Sentiment Trends

- Financial Expert Insights

GME provides investors with expert analysis from financial analysts that provides expert perspectives on its stock predictions. Such perspectives include detailed analyses, market forecasts and strategic recommendations that add credibility and valuable guidance for investing decisions.

- Interviews or Quotes from Market Analysts

Interviewing market analysts can add credibility and insight into market trends, stock performance and predictive accuracy. Interviewing financial experts offers unique perspectives into these aspects as well as providing in-depth analyses that provide expert views into GME’s future prospects. These interviews and quotes add context and professional knowledge about its future potential.

- Predictions from Reputable Financial Institutions

Established financial institutions can provide an objective look into GME’s potential future, with institutions like Goldman Sachs and Morgan Stanley providing well-researched forecasts based on extensive data analysis. Comparing these predictions with FintechZoom’s adds depth to market analysis.

- Perspectives From Both Community and Investor Perspectives

Understanding Retail Investor Community Gaining insights from GME’s retail investor community – who were integral players in its recent history – is of vital importance. Retailer perspectives can often be found online via social media platforms, forums or investment communities, giving a ground-level glimpse of market sentiment and investor behavior.

- Focus on Major Forums and Sentiment Trends

Reviewing discussions on platforms like Reddit gives an in-depth view of market sentiment. WallStreetBets has had significant influence over GME stock movements; therefore analyzing sentiment trends on these platforms helps assess collective investor actions as well as any future impacts they could have on its stock movement.

Risk and Considerations in Detail

- Investment Risks

GME investing presents inherent risks, such as market volatility and company-specific issues. Knowing these risks is essential to creating effective investment strategies and mitigating losses while making more informed decisions. Identifying potential pitfalls will enable investors to protect themselves against losses while making informed decisions more quickly.

- Potential Risks in GME Stock

Being aware of potential GME stock investments risks is crucial to making informed decisions and developing risk management strategies. Key risks can include market fluctuations, regulatory changes and internal company issues; being aware of these can help investors plan accordingly to safeguard their investments and preserve capital.

- Risk Management Strategies for Investors

Key strategies include diversification, market monitoring and setting stop-loss orders to manage risks effectively for investors. Diversifying investments reduces exposure while regular monitoring helps identify threats and opportunities in the market environment. Stop-loss orders provide protection during market downturns by limiting potential losses.

Uncertain Market Conditions

- Unpredictable Factors That May Affect GME Stock

Unexpected events, such as economic shifts or regulatory modifications, can impact GME’s stock performance significantly and cause fluctuations in market prices. Staying informed and adaptable are critical to successfully navigate these uncertainties effectively.

- Staying Up-To-Date With Market News and Mitigating Risks

Staying informed with market news is essential to successful investing, while mitigating risks with measures such as diversifying portfolios or setting predefined investment limits are integral strategies that help investors remain informed. Regularly reading financial news articles, subscribing to market analysis platforms and joining investment communities all help keep investors abreast of market happenings.

Conclusion

Summary of Key Points

Reiterating FintechZoom’s predictions and their implications for GME stock. Summarizing key points helps consolidate information presented and reinforce main takeaways; providing an in-depth knowledge of GME’s stock outlook as well as factors affecting its predictions.

Recap of FintechZoom’s Forecast and Its Implications

FintechZoom recently provided investors with an in-depth recap of its forecast and potential ramifications, outlining key predictions, their causes, and anticipated outcomes – helping investors make more informed decisions and formulate sound strategies accordingly.

Final Thoughts on FintechZoom GME Stock

Provide an in-depth view of GME’s future based on analysis. Incorporating all aspects of the dialogue, these final thoughts give investors an overall picture of GME stock prospects while offering guidance regarding opportunities and risks.

Call to action by the FOP

Stay Up-to-date with FintechZoom for Updates It is imperative that readers stay current with FintechZoom for updated financial insights, market trends and stock predictions. Staying informed allows readers to make timely and successful investment decisions.

Stay Informed and Seek Expert Advice

Advisors advise investors to remain well-informed and seek professional guidance when making investment decisions. Continuous learning and expert consultation enhance investment strategies and decision-making processes. Investors are strongly advised to utilize multiple sources of information and expert guidance when making investment decisions.

Recommending Sources for Financial News and Updates

Suggesting reliable sources for consistent financial news updates. Connecting with reliable news outlets ensures timely, accurate information – such as major publications, market analysis websites, or investment platforms.

FAQs

-

What’s the primary goal for FintechZoom’s GME stock forecast?

FintechZoom’s prediction is based on an analysis of the performance of GME’s stock together sophisticated algorithms and market information to prepare precise forecasts.

-

How precise are the stock forecasts of FintechZoom when compared with other models?

FintechZoom’s predictions have been praised for their accuracy. They are often exceeding traditional models with thorough data analysis and continuous updates.

-

What factors are most influential in the FintechZoom’s GME stock forecasts?

The most important factors are economic indicators, market trends and financial health of companies, and the mood of investors.

-

Can retail investors trust the predictions of FintechZoom when making investments?

Yes, a lot of retail investors consider FintechZoom’s forecasts trustworthy and useful for an informed investment decision on trading on the market.

-

How can I stay up to date on the latest GME stock forecasts from FintechZoom?

It is possible to follow FintechZoom on their site and also subscribe to their weekly updates to receive the most up-to-date information on financial news and stock predictions.